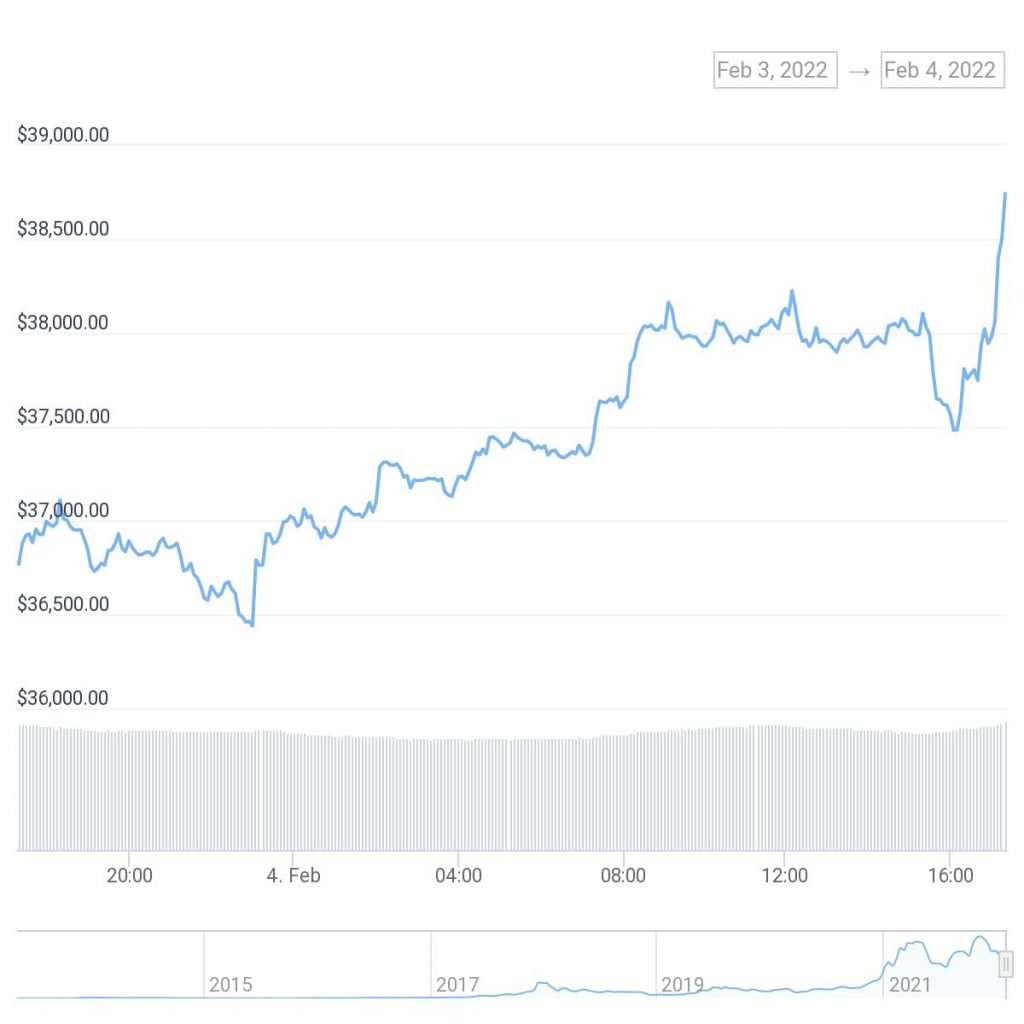

While Bitcoin might have recovered over the week, bouncing back over 6% in the last 24 hours, there are still concerns that more of a correction is on the way.

Source: Coingecko

Looking at the past 24 hours trading, Bitcoin has seen a low trading value of $36,438.72 USD and experienced a high of $38,493.57 USD looking at a 7.3% increase. According to analysts, the $38,000 USD – $39,000 USD region remains crucial to the next few weeks if Bitcoin trading.

The returning strength of tech stocks

As Bitcoin and cryptocurrencies took their first knock, the tech companies across the global stock market saw a dip too. These points to a correlation between the two, indicating that investors in tech tend to lean towards investing in innovative assets like cryptocurrencies.

Looking at the correlation as Bitcoin makes a strong comeback heading into the weekend, tech stock are also facing a similar turnaround. Amazon gained 15% after struggling to regain stability, pointing to a fresh wave of investment in the tech industry despite January’s dip.

Is Bitcoin safe now from another recollection?

Bitcoin might be trending upwards, but it might not mean that it’s in the clear. The token is showing signs of increased volatility and there’s a chance that it might fall back on levels of support. According to market analysts, if Bitcoin can find and hold $38,800 USD there is a possibility that it will create a bullish move.

Looking at the markets, we’re seeing a good bounce of #Bitcoin as a result of $AMZN showing positive numbers & the US indices showing strength.$DXY also showing weakness due to the ECB statements.

For #Bitcoin price action: Let’s first break $38.2-38.6K.

— Michaël van de Poppe (@CryptoMichNL) February 4, 2022

Crypto analyst Rekt Capital echoed this sentiment, saying that the $38,000 USD mark stands as the top resistance point for the cryptocurrency. If Bitcoin can crack through and trade higher and hold it, traders might be looking at a fresh rally following two years of strong bullish trading.

#BTC is still forming an indecision candle just below the key resistance of ~$38650 (red)

That said, for the time being $BTC is able to hold the top of last week’s candle as support

Technically, BTC is still inside the 28000-$38000 range until further notice#Crypto #Bitcoin pic.twitter.com/hOCAbWrcok

— Rekt Capital (@rektcapital) February 4, 2022

What are the altcoins doing in the crypto market?

Ethereum

Over the past day, Ethereum has seen a bullish 9.5% increase in trading value. From a low trading value of $2,590.72 USD over the past day, the leading altcoin nearly tagged $3,000 USD once more with a high of $2,917.37 USD. Over the past week, Ethereum’s performance has risen by 19.9% – from a low of $2,446.56 USD.

Source: Coingecko

It might be 40% off from where it was when it reached its all time high trading value in November, but Ethereum’s strong performance suggests bullish levels of positive trends.

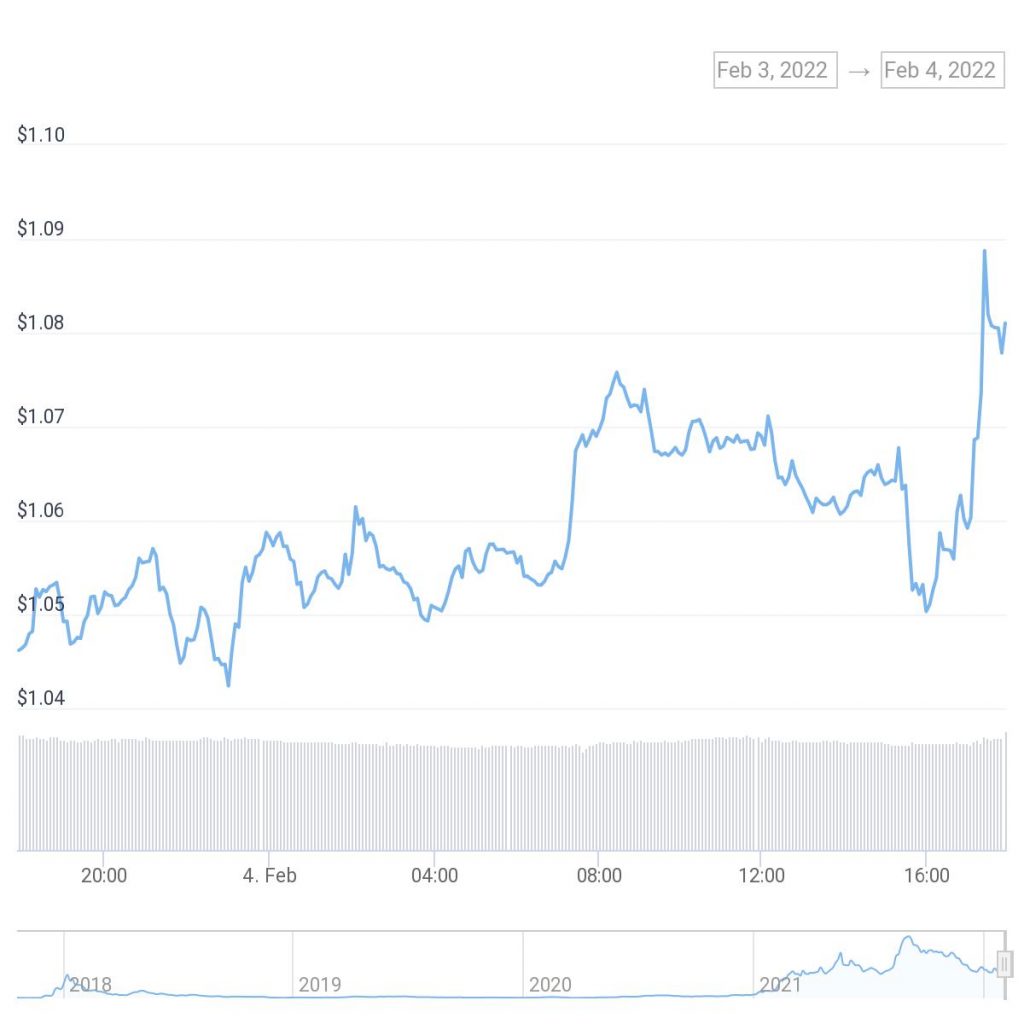

Cardano

Over the past day, Cardano (ADA) has experienced a modest increase, taking the token from a 24-hour low of $1.04 USD to a high of $1.09 USD. It represents only a 3.3% increase, but over the past month, ADA’s performance has held up against the rest of the market.

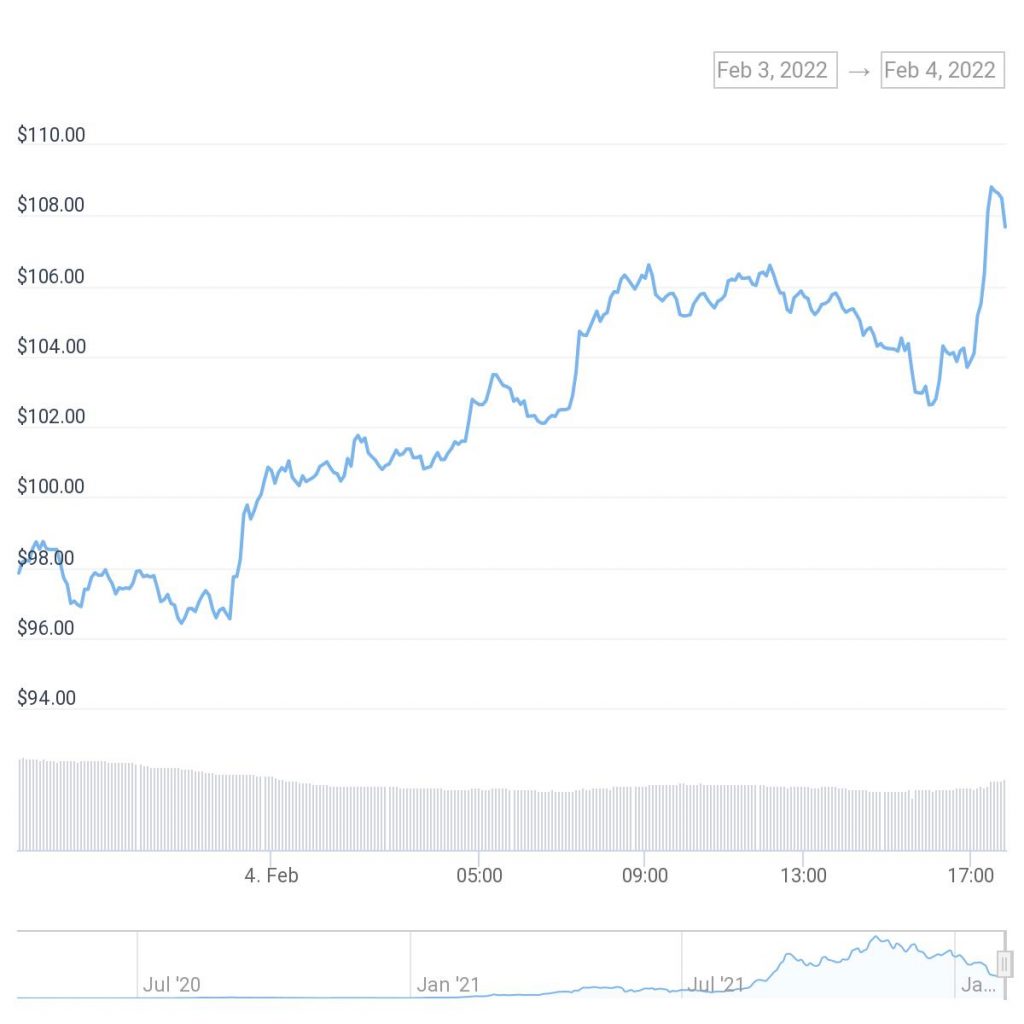

Solana

Solana, sitting in 7th place in terms of trading volume, has seen a spike, increasing by 9.4% over the past day from a low daily trading value of $96.41 USD to experience $108.81 USD. In the last week, it’s gained 19.8% from a low of $90.03 USD.

Time will tell whether the market can regain and maintain strength and hold support levels. If they can, 2022 might not echo the bearish year following 2017’s massive bull run that put crypto on the map as a worthwhile digital asset to add to investment portfolios.

Comments are closed.