In letter

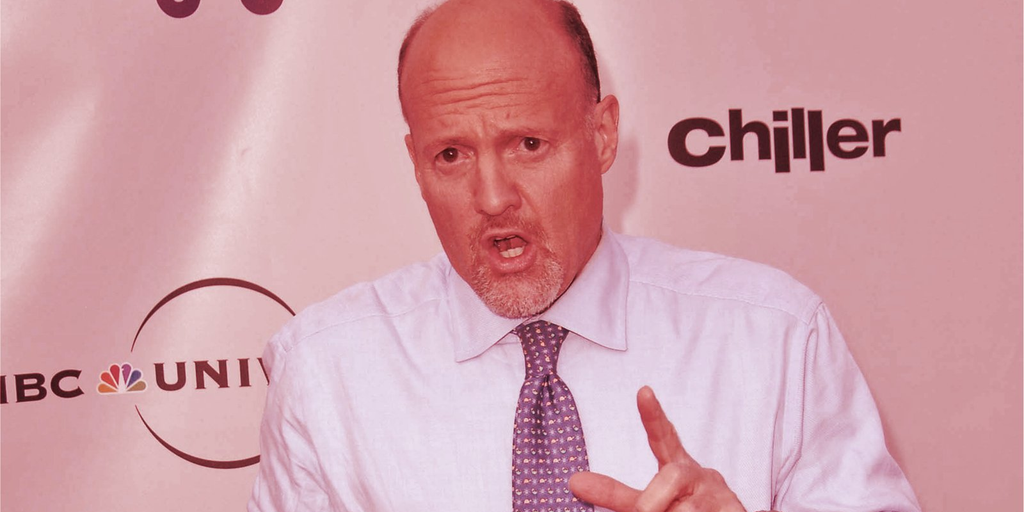

please be careful with Dogecoin…It is a security. It will be regulated. We will find out how many there are and how many are being created each day to make money for the exchanges.

— Jim Cramer (@jimcramer) January 20, 2022

Does $DOGE meet the definition of a security?

Considering that it is proof of work and the creator warns people that it is a joke and not to buy it, I would say no. pic.twitter.com/AC90Xj1JDb

— THE MAYOR OF MATIC (@MayorOfMatic) January 20, 2022

Comments are closed.