- The whales on Curve Finance have requested for extra gauges to be added to Ethereum.

- CRV was considerably overbought at press time and may be due for a value correction.

Following a request from whale addresses on its platform, Ethereum-based decentralized finance (DeFi) platform Curve Finance has put ahead a proposal so as to add extra gauges to its liquidity swimming pools on Ethereum.

After seeing how nicely v2 swimming pools work with totally different tokens given sufficient liquidity, there was a request from whales for extra gauges on Ethereum. Including one per a number of weeks, we begin that batch with MATIC/ETH – up for a vote now! https://t.co/LAnrvFSNJh

— Curve Finance (@CurveFinance) January 22, 2023

the gauge system on Curve Finance measures the liquidity of a selected pool or set of swimming pools on the platform. The gauges are used to find out a given pool’s stability payment (or rate of interest), with swimming pools with decrease gauges having a better stability payment. With gauges on Curve Finance, liquidity is distributed evenly amongst its swimming pools.

Learn Curve Finance’s [CRV] Price Prediction 2023-24

In keeping with Curve Finance, the request for including extra gauges to the Ethereum Community was as a result of success of its V2 swimming pools made up of various tokens with adequate liquidity. These gauges will likely be added by including one gauge per a number of weeks, beginning with the MATIC/ETH, Curve Finance mentioned.

Including extra gauges to the Ethereum community on the Curve Finance platform will increase the variety of swimming pools accessible for customers, offering extra choices for exchanging varied belongings.

As of this writing, all 22 solid votes have been in favor of including extra gauges.

Supply: Curve Finance

CRV amongst the highest gainers

In keeping with CoinMarketCapthe Curve DAO Token [CRV] noticed a 20.89% enhance in worth over the previous week, making it one of many high 5 cryptocurrencies with the very best features throughout this era. As of this writing, the altcoin traded at $1.08, having seen a 7% value leap within the final 24 hours.

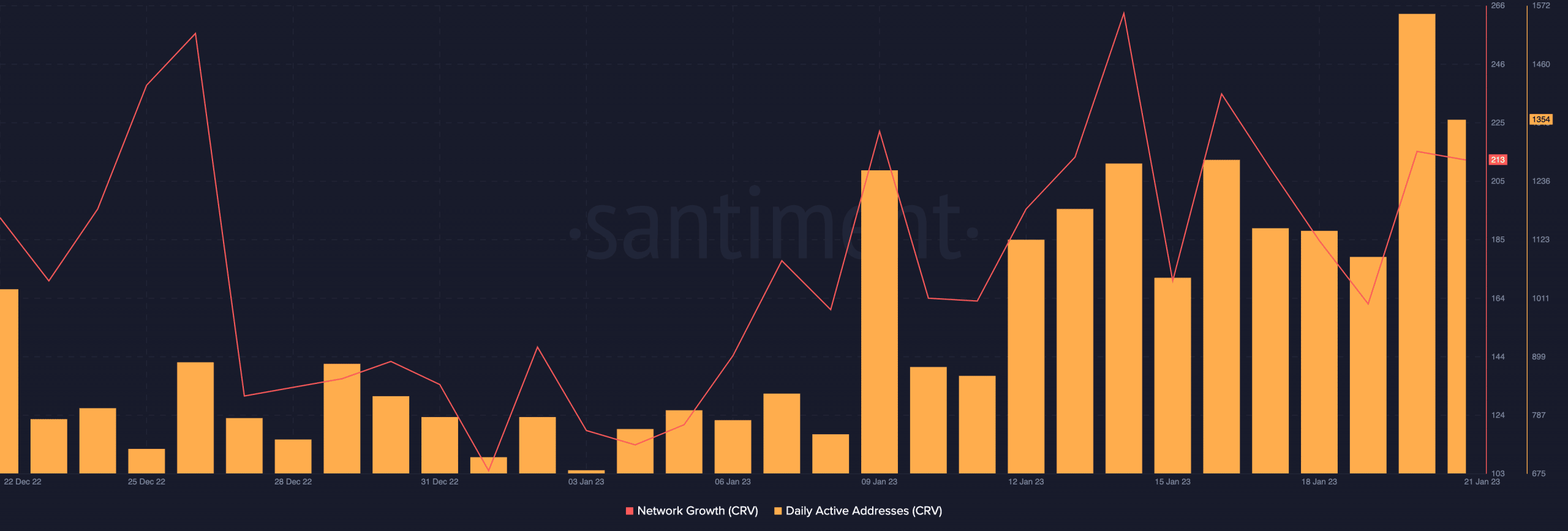

As the general cryptocurrency market has been displaying constructive sentiment for the reason that begin of the yr, the variety of distinctive addresses buying and selling CRV tokens has elevated since 1 January.

Moreover, there was a big rise in demand for the token because the each day variety of new CRV addresses created has elevated by 103%.

Supply: Santiment

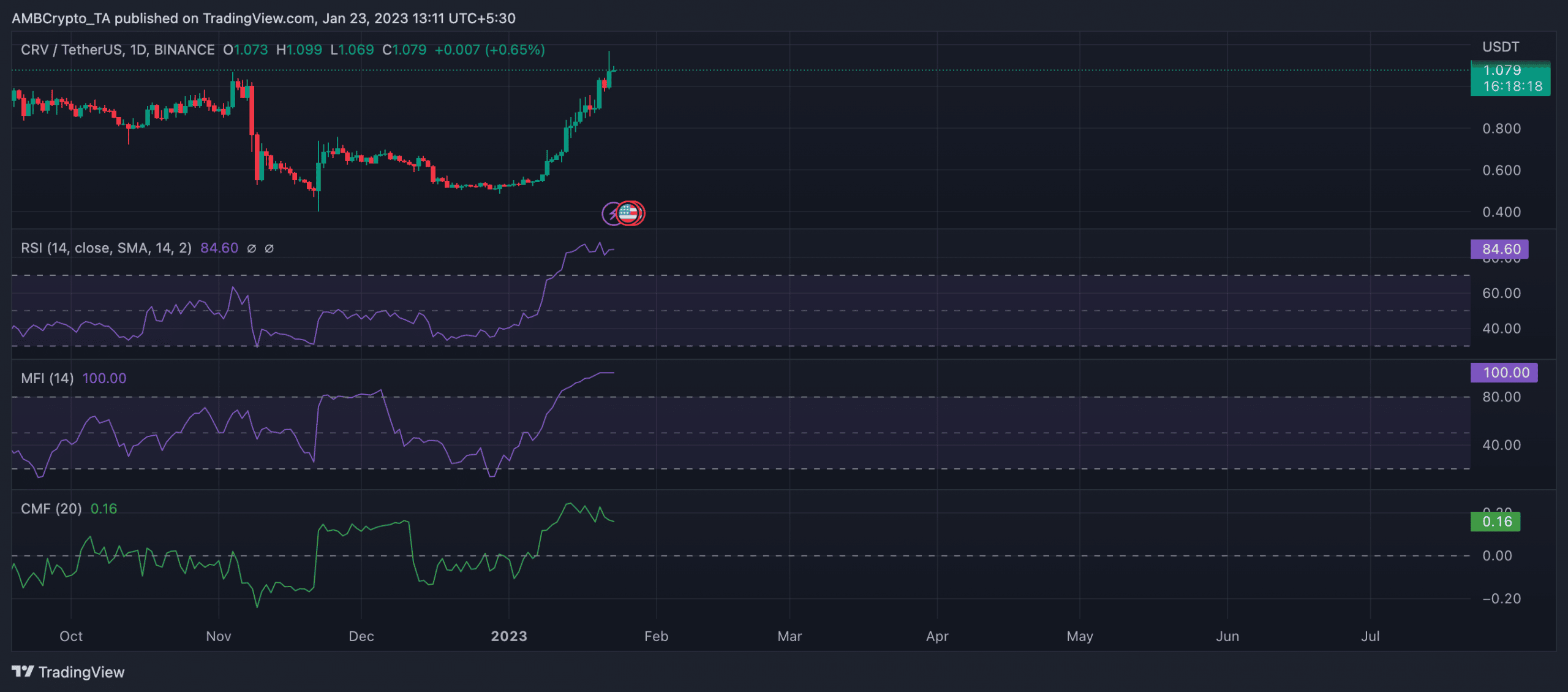

With elevated CRV accumulation for the reason that yr began, the old was overbought at press time. Its Relative Power Index (RSI) was 84.60 Its Cash Stream Index (MFI) was noticed at its highest place ever, 100.

At these considerably overbought highs, a value correction is frequent. Consumers usually discover it difficult to assist any additional value rally at these highs, and the bears usually return to the market to provoke a value drawdown.

A have a look at the alt’s Chaikin Cash Stream (CMF) confirmed this. At press time, CRV’s CMF was noticed in a downtrend, though nonetheless above the middle line.

Is your portfolio inexperienced? Try the CRV Profit Calculator

When an asset’s CMF is trending downward whereas the value of the asset is growing, it may well point out that the asset’s value is rising on weak shopping for strain. It signifies that the asset is being purchased by a smaller variety of buyers or that the shopping for strain must be stronger to assist the worth enhance.

This usually means that the asset is overbought and {that a} value correction is greater than more likely to happen.

Supply: Buying and selling View CRV/USD

Comments are closed.