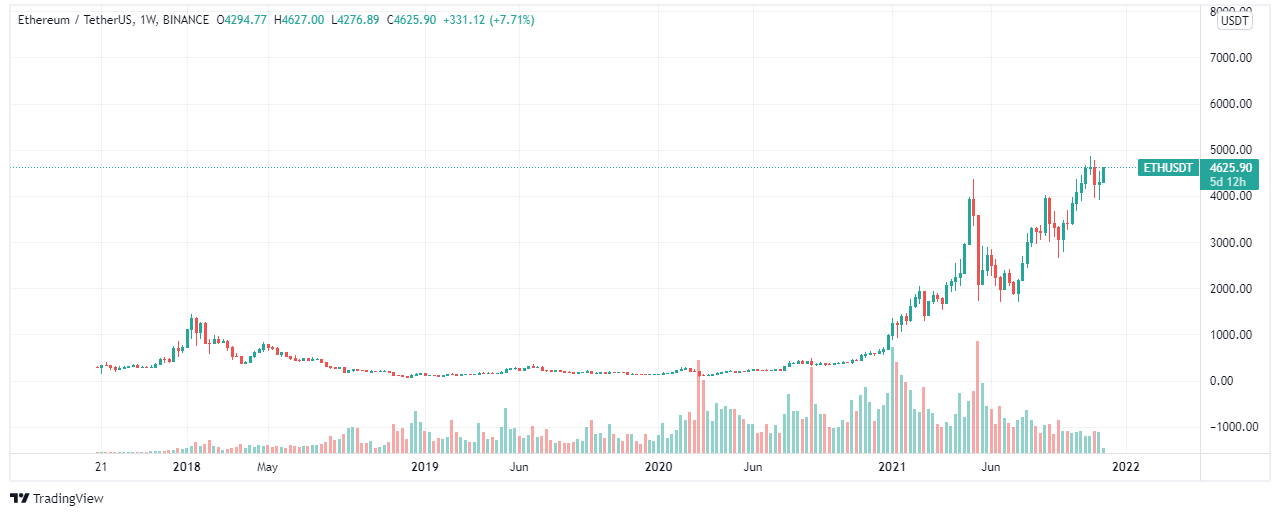

ETH price history – Coinbase chart

Even some Ethereum investors that entered in April-2021 made up to 1.5x gains after a sharp price correction of more than 60%. Today, the Ethereum price is trading at $4320, maintaining a continuous uptrend from $2795.

In this guide, we’ll review predictions for the Ethereum (ETH) price and speculate how high the popular utility-driven cryptocurrency could go.

Ethereum Price Now – Live Price Chart

At the time of writing, the ETH price chart is showing around $4320, with a 24-hour trading volume of $17.8B. Ethereum now has a market cap of around $511 B or 16% market domination. The market has 118.5M ETH in total circulation.

Review the ETH live price chart on sites like Coinmarketcap or Coingecko for the latest price of Ethereum now, or refer to our ETH price chart below.

The ETH crypto is currently ranked 2nd behind Binance coin and USDT in terms of market capitalization. ETH token reached an all-time high price of $4868 on November 10, 2021, after a sharp fall up to $2652. The token maintained its upward rally from early 2021 and now is at its all-time high.

In the short term, e.g., on the daily or weekly timeframe, some traders may consider the price action bearish and have decided to sell Ethereum (ETH). Others with a long-term bullish outlook will be looking to buy the dip and hold ETH for a retest of the highs and further price discovery.

Where can I buy Ethereum in December 2022

=

![]()

Stellar

1 Providers that match your filters

1 Providers that match your filters

for $1000 you get0.8390 ETH

FeaturesCopytrade winning investors

for $1000 you get0.8390 ETH

68% of retail CFD accounts lose money.

eToro is our top recommended trading platform for customers looking to buy Ethereum. With over 13 million customers and counting, the site is highly popular throughout the world. If you’re buying Ethereum for the first time, eToro is the ideal place to start.

Given its decade of trading expertise, eToro has distinguished itself from the plethora of trading platforms available by utilizing a social trading approach to investment and emphasizing user experience.

eToro has successfully transformed the complex and perplexing world of financial speculation into a platform where individuals can interact and learn from one another. The online brokerage provides a diverse range of financial options.

It is home to several cryptocurrencies, including Ethereum. They are available for buying and selling against fiat currency. The trading fees are another advantage of the platform where you may trade without paying fees and use eToro’s Copy Trader function to mimic the actions of top traders.

eToro is a licensed cryptocurrency broker with operational licenses from the UK, the United States, and Cyprus.

Visit eToro

Your capital is at risk.

Ethereum (ETH) price over the years

Ethereum was created by Vitalik Buterin. He proposed the idea in 2013 and finished the project with the aid of crowdsourcing in 2014. Since then, it has increased in popularity and is now the second most valuable cryptocurrency in terms of market value, trailing only Bitcoin. Ethereum’s coin price history started when it was trading at $2.80, but it swiftly dropped to a trading range of less than $1.

That would be the case for the rest of 2015, as all cryptocurrencies faced a lengthy bear market. The markets began to accelerate in 2016, and the price of Ethereum progressively grew until it crossed $13. From there, it fluctuated between $8 and $14 before a pivotal event in Ethereum’s history highlighted the platform’s shortcomings.

The rise of DAO and the sudden fall

In 2016, the Decentralised Autonomous Organisation (DAO) took place. This was a smart contract system built on top of the Ethereum network. The DAO was able to raise $150 million through a crowd-sale with the assistance of some prominent members of the Ethereum community. However, calamity struck the DAO when a hacker exploited a technical hole and stole $50 million.

The hack triggered a frenzy of discussion in the Ethereum community on how to deal with the issue. Finally, the decision was made to hard-fork Ethereum, reversing the transactions and recovering the lost funds.

As the fork lacked total consensus, Ethereum Classic was created, which carried on the original chain. The hard-fork is still a contentious issue, with many questioning Ethereum’s immutability as a result.

The DAO leak was destined to harm the price of Ethereum. Following a peak of $20, the cryptocurrency dropped to $12 before continuing to plummet, finally hitting a low of around $6.30. Despite this, when 2016 came to an end, and 2017 arrived, things were about to change.

Ethereum’s Beacon chain

Ethereum 2.0 went live in December 2020, resulting in the construction of a Beacon Chain that could be used to organize Ethereum 2.0’s network of stakers and shards. This tool was designed to be changed and improved in the future, but it was the most significant move toward Ethereum 2.0 yet.

The chain was also used to get the system ready for sharding. This would imply dividing Ethereum’s digital architecture into smaller portions in order to facilitate scalability by increasing the platform’s storage capacity.

This enabled users to store a fraction of the system’s huge and developing data, making it more resilient and scalable and ultimately letting it become the “global computer” that its inventor Vitalik Buterin always envisioned. On December 1, 2020, Ethereum hit a low of $601 and a high of $739 at the end of the year.

The 2021 NFT saga

The sale of Beeple’s Art, without a doubt, drew a lot of attention. NFTs, or Non Fungible Tokens, were established on the Ethereum blockchain and used digital tokens to represent the sale of items like wine, vehicles, and art. Christy’s helped organize the Beeple sale, which featured a collage of his ‘Everydays’ project. The NFT was finally auctioned off for $69 million.

In March 2021, Jack Dorsey, the founder of Twitter, auctioned off the first tweet on the network for charity, raising $2.9 million and following the NFT trend that has swept the market. The auction was conducted by Valuables, an online auction service.

In the spring, when cryptocurrency prices fell, the value of Ethereum fell by about 60%. After reaching an all-time high of $4,362 in May, it fell to $1,700 in July.

As the Chinese government attempted to outlaw cryptocurrency mining and trading, pessimistic sentiment weighed on the market. The price of ETH surged in 2021, comparable to the price of Bitcoin (BTC), but for different reasons: For example, Ethereum made news when a digital artwork sold for more than 38,000 ETH (69.3 million USD) as the world’s most expensive NFT.

Unlike Bitcoin, which rose in value due to the IPO of Coinbase, the largest crypto exchange in the United States, Ethereum rose in value due to technological advancements that aroused traders’ attention. First, the so-called “Berlin upgrade” was published on the Ethereum network in April 2021, opening the way for lower ETH gas prices or cheaper transaction fees. Second, the introduction of Uniswap V3, a smart contract technology, in May 2021 is expected to enhance Ethereum trading even more.

However, in October 2021, Ethereum reached a new all-time high of almost $4,400 following an upgrade. Altair, an important upgrade to the Ethereum network, went live in October, skyrocketing its prices to an all-time high.

Altair is the Ethereum Beacon Chain’s first update following its December 2020 debut. The Beacon Chain is significant because it is the first implementation of PoS in the Ethereum ecosystem.

At the moment, Ethereum has both a PoS and a PoW chain operating concurrently. Both chains have validators, but the PoW chain is the only one that handles user transactions. However, in 2022, the Ethereum blockchain will completely merge with the Beacon Chain, converting it from a PoW to a PoS architecture.

Assuming that all steps go properly, the new Ethereum 2.0 should emerge from the process in a good position to eventually end Bitcoin’s long reign as the cryptocurrency market’s monarch. Ethereum 2.0 makes use of the sharding method, which allows ETH to grow from 30 to 100,000 transactions per second on average.

This significantly improves Ethereum’s potential, making it a highly interesting coin to watch in 2022 and beyond. It will be a dependable system with far fewer scalability difficulties, a lot more extensive feature set than its primary competitors, and hence an excellent alternative for investors to invest in.

Buy Ethereum

Your capital is at risk.

How is the price of Ethereum (ETH) determined?

Supply and demand

The supply and demand of Ethereum influence its price in the market. These markets feature order books with buying and sell orders like the stock markets. An increase in demand for ETH coins will cause the price to rise, while an increase in sell order supply will cause the price to fall.

Ethereum in the media

Ethereum was in the spotlight in mid-2021 for its meteoric gains of more than 400% that was led by the rise in demand for NFTs. Numerous major media sites included ethereum in their headlines, which encouraged people to purchase more of these tokens, thereby skyrocketing in prices.

Forbes stated how Ether was growing into fame after the rise of NFTs in mid-2021. It mentioned how crypto gained 530% in 2021 alone and predicted that it would be bullish for the coming years. On the other hand, ethereum was questioned for its rise in gas fees and network congestion that led many Dapps and DAOs to move away from the ecosystem.

CNBC also took the opportunity to feature ETH in their headlines, stating that how the crypto skyrocketed in mid-2021. They also mentioned the reason for it reaching its all-time high. Even Mark Cuban was featured stating that why he is favoring Ethereum compared to bitcoin. They ended up by saying the potential of ethereum, and it may take over bitcoin in the near future.

Volume

Volume plays a major role in determining cryptocurrency prices. An increase in transaction volume results in more stable cryptocurrency values and eliminates the possibility of skewed pricing. However, a low crypto volume indicates the prices will fall or remain flat.

Social Media

Social media has never been a driver for ETH prices. Although, Ethereum has reacted to market FUDs and other events but has never seen price spikes due to any Twitter tweets or Reddit pumps. In fact, it is considered one of the trustworthy and deserving cryptocurrencies. It also has a loyal community of developers, users, and investors, all of whom have contributed equally to the growth of the ETH crypto price.

Ethereum Mining

Another determinant of Ethereum’s prices is its mining capability. Mining is the process through which new cryptocurrency tokens are created. Cryptocurrency mining entails the use of a computer to validate the next block on the blockchain. Its decentralized network of miners is what enables it to function as it does. In exchange, the protocol generates cryptocurrency tokens in addition to any fees paid to the miners by the trading parties.

Participants invest significant sums of money in high-end hardware and power to mine Ethereum. In a proof-of-work system, such as the one used by Ethereum, the greater the competition for mining a particular cryptocurrency, the more difficult it is to mine. That is because miners are effectively competing against one another to solve a difficult mathematical problem to verify a block. As a result, the cost of mining grows as more powerful equipment is required to mine effectively.

As mining expenses rise, cryptocurrency prices are set to rise as well. Miners will refrain from mining if the value of the mining money is insufficient to cover their expenditures. And, because miners are necessary for the blockchain to function, the price will have to increase as long as there is demand for the blockchain.

However, Ethereum is expected to transition from a proof-of-work to a proof-of-stake consensus mechanism in the future, potentially eliminating the mining process for ETH tokens.

How often does the price of ETH change?

Ethereum is a utility token, and its value has grown as more people have flocked into this cryptocurrency. The crypto price had risen by almost 400% in 2021 alone, valuing the project at more than $511 billion. While ethereum is being criticized for its high gas fees and network congestion, crypto has managed to maintain market dominance.

So, how often does the price change? Starting in June 2021, the ethereum value rose to ATH of $4868 and has maintained a continuous uptrend, currently trading around $4445.

The reason for the spike in ETH token prices is the rise in demand for the blockchain network. As more and more crypto startups are coming into the space, the demand for ethereum is rising. Another reason for its bullishness is the rise of the NFT saga in 2021. For example, the most popular NFT marketplace OpenSea saw tremendous figures in terms of sales, and this led to a jump in prices of ethereum.

So, one can say that the ethereum crypto price has changed based on the rise of the NFT mania and its market dominance. However, every individual must take due diligence before buying Ethereum. Ethereum may be fluctuating at times due to many reasons like FUD in the market, negative news, etc.

As a result, beginner investors may find it difficult to understand how to enter and exit this volatile market, but the following industry experts may help you find the right opportunity to enter and exit the market. InsideBitcoin is one such platform that is focused on actively monitoring the crypto market 24/7. The platform evaluates all the specifics of the market and gives investors the right help for their investments.

Invest in Ethereum

Your capital is at risk.

Investing in Ethereum

Ethereum is the second-largest cryptocurrency in terms of volume, but its numerous applications might result in a considerably steeper learning curve for novice investors than Bitcoin. However, ethereum acts as a conduit for decentralized finance. It serves two functions: first, it functions as money and may be used as a store of wealth.

Unlike Bitcoin, which generates value as “digital gold,” Ethereum is a blockchain-based software platform. Users can engage with the platform using Ether, Ethereum’s native cryptocurrency, or purchase and retain it as a store of wealth. While developers frequently utilize Ethereum, some individuals buy in the cryptocurrency for its potential to appreciate over time.

Is It Worth Buying Ethereum in December 2022?

Ethereum has been on a continuous uptrend, and the future is bright for this cryptocurrency. Firstly, it has greater market dominance in the NFT and DeFi space. It is also set to upgrade to ETH 2.0, which could solve all the existing issues within the ecosystem.

Due to the significant volatility of cryptocurrency values, they are riskier investments than conventional financial assets. Whether ETH is a good investment for your portfolio is situational and risk-averse. You should keep in mind that previous success does not guarantee future results.

As is usually the case, you should conduct your research and choose the degree of risk you are willing to accept before investing your money.

Who should invest in Ethereum ?

Ethereum has proved to be one of the best blockchains ever created. The crypto is full of utilities and solutions to different problems in the blockchain space. Moreover, its decent gains have made it an appealing investment choice.

So, who should invest in Ethereum? Anyone who understands the history, present, and future of this crypto can invest in it. Ethereum could be one of the best bets. As the network is set to launch its ETH 2.0 version, we may see a tremendous uptrend in ETH prices. It’s just about how you understand the technology.

How to Get Started investing in Ethereum?

You can get started right away with these three quick steps to buy Ethereum:

- Open an account with eToro – To purchase ethereum, we recommend utilizing the reputable cryptocurrency broker eToro. The regulated platform provides super-low costs, fund safety, several deposit ways, and a comprehensive library of investing options. To begin, go to the eToro website and select ‘Join Now.’

- Upload ID – As eToro is a licensed broker, you will be required to provide identification. You may upload a copy of your driver’s license or official ID card, along with a copy of a recent utility bill or bank statement.

- Deposit Funds – Once done with uploading credentials, you can fund your account with the minimum deposit required as per your location. Simply go to ‘Deposit Funds’ and choose your desired deposit method.

- Buy Ethereum (ETH) – After depositing funds, open eToro and enter ‘ETH1xM’ into the search field to purchase ethereum. On the first result, click ‘Trade’ and enter the amount you wish to invest in the ethereum cryptocurrency.

Investing in Ethereum responsibly

Investing in Ethereum comes with risks. The token has a stable history of a continuous uptrend. However, it is advisable to know how crypto markets operate and the market’s fundamentals and technicals.

Here are a few tips that may help you to invest responsibly:

- Allocate only a small percentage of your portfolio to cryptocurrencies

- Research before choosing any crypto for investment

- Choose the best platform to buy crypto.

- Store your cryptocurrency safely with hardware wallets

- Secure your cryptocurrency by using a VPN

Moreover, it is also suggested to take advice from experts. Following money management and risk management strategies is essential to safeguard your capital. Similarly, research with the help of advanced platforms like InsideBitcoins is recommended.

Open eToro Account

Your capital is at risk.

Ethereum Taxation

Buying and selling cryptocurrency is taxable since the IRS considers it to be property rather than cash. As a result, tax regulations that apply to property transactions (but not real estate transactions), such as selling valuable coins or antique vehicles that can rise in value, also apply to bitcoin, Ethereum, and other cryptocurrencies.

Hence, gains made from ethereum or any other crypto are taxable, and failure to declare income may result in fines from the IRS. However, not every aspect of a crypto transaction is taxed, but certain limitations govern every aspect.

According to the IRS, buying ETH with other crypto or vice versa and receiving mined tokens is taxable. Similarly, selling ethereum (ETH) for cash or using Ethereum to pay for goods and services is also taxable.

However, not every transaction is subject to taxes, and it is exempt if you donate ethereum to a qualified tax-exempt charity or non-profit. Similarly, buying ethereum tokens and holding them or transferring them between wallets is also exempt from tax.

Ethereum vs. other cryptos

Ethereum is one of the best blockchain networks that has ever existed. It is home to one of the best projects in the cryptoverse. Ethereum was founded in 2013 by Vitalik Buterin. The platform dominates the crypto market as the best blockchain network ever created. However, one disadvantage of Ethereum is that it still uses the PoW mechanism.

This consensus mechanism has led to an increase in gas fees within the ecosystem. Any transaction within the ecosystem costs huge for users. Hence, investors are now diversifying to other blockchain networks due to its pitfalls.

However, it still maintains its market dominance and has raised standards for other cryptocurrencies as well. Let’s look at other cryptos and how they are different from Ethereum:

Ethereum vs. Shiba Inu

Like Dogecoin, Shiba Inu is an open-source, peer-to-peer cryptocurrency based on the Ethereum network, also regarded as a meme token. It was launched in August 2020 and is based on the Japanese dog breed Shiba Inu. Founded by an anonymous person called Ryoshi, the token is a ditto copy of Dogecoin. Moreover, it is regarded as a ‘Dogecoin Killer,’ and the coin has generated 1000000% gains alone in 2021.

Ethereum vs. Bitcoin

Bitcoin is decentralized digital money that was first introduced in January 2009. It is based on the principles presented in a white paper by the pseudonymous Satoshi Nakamoto. It promises reduced transaction costs than standard online payment channels and, unlike government-issued currencies, is run by a decentralized authority. It is still the gold standard for digital assets such as Dogecoin.

Compare Ethereum Exchanges & Brokers

Day-Trading Ethereum vs. Long-Term Ethereum Investments

Depending on your objectives, you may choose Ethereum for either long-term investment or day trading.

This coin looks to be well-positioned for long-term growth. This makes it appealing to investors seeking big returns who don’t mind the coin’s potential volatility along the way. However, investors should keep in mind that Ethereum killers are on their way to taking over its market dominance. For example, Solana is touted as the real ethereum killer as it is fast, cheap, and scalable compared to other networks.

At the same time, ethereum’s volatility makes it a viable short-term trading target. The coin has seen massive price swings in each of the previous months, creating possibilities for skilled traders to benefit.

However, investors have to do due diligence before investing in any cryptocurrency. One must conduct their research and invest based on a few factors like the capital allocation for the trade/investment and availability.

The research process may be time-consuming as it requires you to go through a lot of genuine resources. To make things easy, you may consider using professional research platforms like InsideBitcoins. The platform offers comprehensive study instructions on numerous cryptocurrencies and makes the research process simple. The platform allows you to make wise decisions about your investments at the appropriate time.

Moreover, InsideBitcoins continuously monitors the crypto market and provides the best information needed for any individual investor. Additionally, you may seek the assistance of crypto bot traders, which will automate the process of studying and investing at the optimal time and save you time and effort.

Buy Ethereum Now

Your capital is at risk.

Future Predictions for Ethereum Price

Ethereum price prediction for 2022

With partnerships, alliances, and community investment, the market expects ETH to do well, reaching a price of $5000, which is fairly optimistic in terms of pricing but unquestionably achievable in the near future.

Ethereum price prediction for 2023

Ethereum, too, may experience cloudy days as a result of policy and regulatory developments. Suppose Ether crypto successfully retains the support level around the 200-day long-term moving average. In that case, purchasers will have adequate time and stability to create the next attack mission on the critical $4100 level, preventing it from plummeting but playing continuously.

Ethereum price prediction for 2024

According to the platform’s newest news updates, technological improvements, ETH price predictions, and new project estimates, we can anticipate several collaborations and integrations around 2024. This might result in an increase in the price of ETH in the market, which would be the greatest investment, as the price could reach approximately $5200. However, if the ETH price experiences a reversal, it may trade around its critical support level of $4900

Ethereum price prediction for 2025

ETH’s race to the climax over the next four years will be made easier by the availability of extra short-term, medium-term, and long-term price objectives for buy or sell orders. Starting with a long-term price of $5200, this suggests that ETH might reach a new all-time high of $5600 within the next five years.

Read more Ethereum price predictions.

Conclusion

Ethereum is one of the most established participants in the crypto space that has a tremendous reputation for trust among commercial firms. Its enormous developer community, which is dedicated to improving the blockchain’s protocol, may be viewed as a technological advantage for corporate organizations. Additionally, its protocol’s real-world applications span 11 primary sectors in which enterprise firms may be interested.

The blockchain giant’s growth is expected to reach extremes, akin to the ICO craze. It is presently trading at over $4445, implying a more than 450% return for investors over the previous year. Ethereum has long been dubbed the “miracle currency” by application developers, and solutions to real-world problems like money transfers and distributed finance have been discovered.

With Ethereum demonstrating such promise, it has garnered support from all industry crypto connoisseurs who believe that when backed by a fundamentally sound algorithmic science and a track record of consistent performance, Ethereum can be a superior investment to Bitcoin, but only if invested at the right time and with the appropriate price gauge.

It is frequently stated that the ‘future of the internet will be decentralized,’ and without question, Ethereum will play a vital role in accomplishing this goal. Some top cryptocurrency traders predict ETH will flip BTC in an event known as the flippening – Ethereum overtaking the marketcap of Bitcoin.

To invest in ETH and read further about Ethereum token price forecasts, visit eToro, a social trading site where investors may discuss the tokens they purchase. Network with a community of other traders to find out how high they think the Ethereum price can go.

Key takeaways:

- Investing or trading Ethereum or any crypto is very risky.

- Ethereum now has 115.7 million coins in circulation.

- Ethereum is popular as it provides best-in-class use cases to crypto projects.

- Ethereum ranks 2nd under Bitcoin and has market domination.

- Ethereum has great potential with its use cases rising.

- Investors need to follow their due diligence before investing in ETH.

eToro – Our Recommended Ethereum Platform

- Monthly Staking Rewards for Holding Ethereum (ETH)

- Free Secure ETH Wallet – Unlosable Private Key

- Regulated by FCA, ASIC and CySEC – Millions of Users

- Copytrade Profitable Ethereum Investors

- Buy with Credit card, Bank wire, Paypal, Skrill, Neteller, Sofort

68% of retail investor accounts lose money when trading CFDs with this provider.

Is ETH coin a good investment?

nvesting in Ethereum is risky, but it has the potential to be profitable. As compared to Bitcoin or Litecoin, businesses are primarily adopting Ethereum as a building block. This could be a possible victory for an investor in the long run.

How much is the ETH coin?

At the time of writing, one ETH token is worth $4,449.75. However, the value is set to rise in the future, considering the ETH 2.0 upgrade.

How to buy an ETH coin?

Firstly, you may choose a cryptocurrency exchange and open an account. Second, add the minimum funds required to buy ethereum. Lastly, select ETH from the list of coins present in the exchange and confirm your buying position.

How to get a free ETH coin?

To get your free Ether (ETH), just register on websites that offer free crypto for completing surveys, viewing movies, or fulfilling offers, and immediately redeem your points for Ether or any other crypto of your choice. You may then transfer the redeemed Ether to any of your wallets.

Comments are closed.