EOS is a blockchain platform that seeks to address these bottlenecks through its delegated proof-of-stake (DPoS) consensus mechanism. Running a web toolkit for interface development, EOS enables hassle-free dapps development. With its ability to support thousands of applications on its network and its no-fee model, EOS blockchain has gained blockchain prominence in a few short years.

On this Page:

Contents [show]

If you are looking for some of the best places to buy EOS, this guide should come in handy. You may have come across several platforms that support EOS, but it may be difficult to choose one due to several issues. Each platform offers different fee structures, features, and the overall trading experience.

This guide explains how you can buy EOS commission-free and the best platforms to use for trading.

Best Places to Buy EOS in December 2022

Before we go ahead, let’s explore some of the best places to buy EOS this year. Our top choices include:

These online brokers above were carefully selected and reviewed as the best brokers to buy EOS today. They operate with low fees, offer swift transactions and a broad selection of payment methods including PayPal and Debit Card payments.

In summary, they make it easy for anyone to buy EOS. The reviewed brokers are also quite liquid. Liquidity enhances the trading process–which is a blessing for traders.

Finally, the platforms above offer high-end security architecture to protect your personal details and your cryptocurrencies.

eToro – Our Recommended Crypto Platform

- ASIC, CySEC and FCA regulated – 20 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet – Unlosable Private Key

- Staking Rewards for holding ETH, ADA or TRX

- Copytrade Winning Crypto Traders – 83.7% Average Yearly Profit

68% of retail investor accounts lose money when trading CFDs with this provider.

How to Buy EOS – Quick Guide to the Best Brokers for Buying EOS in December 2022

Do you want to buy EOS right now? If yes, you can follow the four quickfire steps outlined below to get started.

- Open an account: You’ll first need to open an account with a trusted cryptocurrency broker. We recommend eToro, as the platform is heavily regulated, supports multiple deposit options with super-low fees.

- Upload ID: As a regulated brokerage site, eToro will ask you to upload a copy of your government-issued ID.

- Deposit: You can now deposit funds with a debit/credit card, Paypal, Neteller, Skrill, or a bank wire.

- Buy Bitcoin: Search for ‘EOS’ and click on the ‘Trade’ button. Enter the amount of EOS coins you wish to buy ($25 minimum) and confirm the order.

You will now have EOS in your eToro portfolio. Most investors will keep their EOS funds on the eToro platform until it’s time to cash out. You can, however, also withdraw your EOS to the eToro crypto wallet.

How to Buy EOS- eToro Tutorial

Looking for a more comprehensive walkthrough of how to buy EOS online? If so, the section below will show you exactly what you need to do to get your hands on EOS in the safest and most cost-effective way possible.

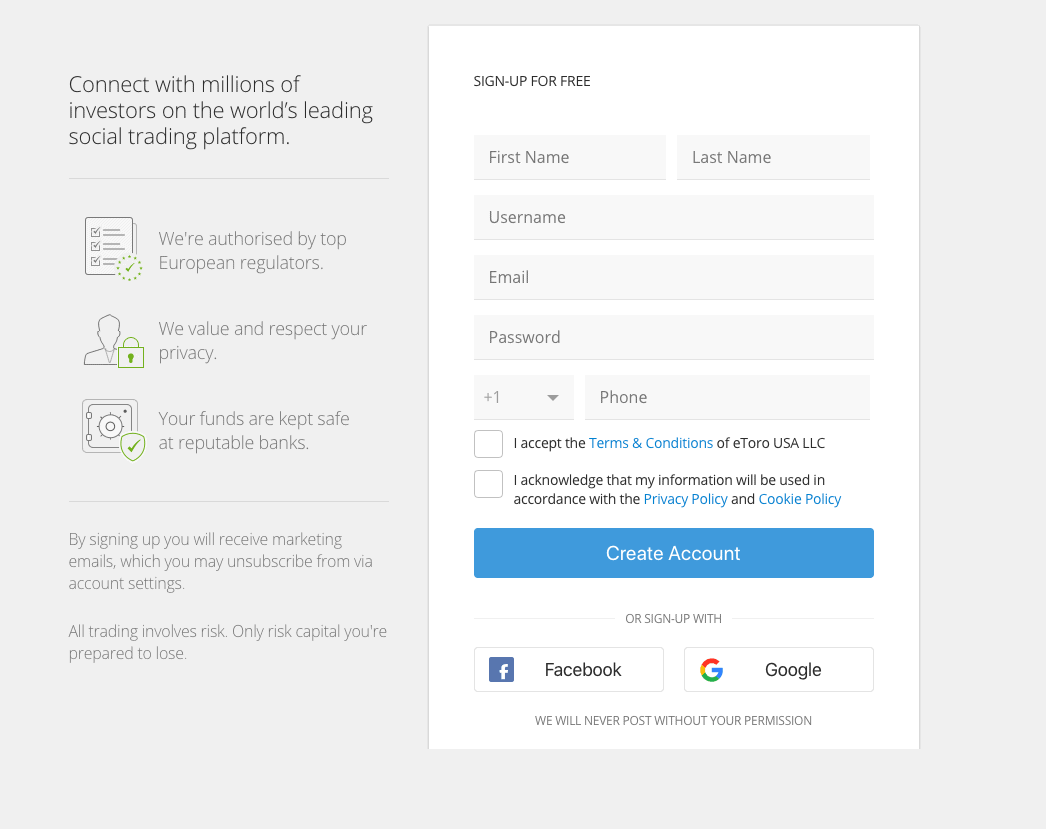

Step 1: Open an Account

The end-to-end process of opening an account, depositing funds, and buying EOS can typically be completed in less than 10 minutes at eToro. The broker uses automated technology to verify your personal details.

So, to get the ball rolling, visit the eToro website and look out for the ‘Join Now’ button.

You will see a box like the image below and will need to enter your first and last name, email address, phone number, and a username and password.

67% of retail investor accounts lose money. Invest responsibly.

On the next page, you will then be asked for additional personal information – such as your country of residence, home address, date of birth, and national tax number. eToro will then send an SMS to your mobile phone. To complete your registration, enter the code that eToro sends you when prompted.

Step 2: Upload ID

As noted above, eToro is regulated by several reputable agencies. As such, you will need to have your identity verified. You can actually complete this step at a later date – but it does need to be done before you are able to:

- Deposit more than $2,250

- Make a withdrawal

With this in mind, it’s best to quickly upload the required documents now to avoid any delays in the future.

This requires a copy of your:

- Passport, driver’s license, or national ID card

- Utility bill or bank account statement issued within the last 3 months

In most cases, eToro will authenticate your documents straight away and subsequently remove all account restrictions.

Step 3: Make a Deposit

The next step is to deposit some funds. Apart from a bank transfer, all deposit methods are credited to your account instantly.

You can choose from:

- Debit/credit card (Visa, MasterCard, Maestro)

- Paypal

- Skrill

- Neteller

- Local bank transfer (country-specific)

- International bank wire

In terms of fees, eToro charges just 0.5% on deposits – irrespective of the payment method. This is much cheaper than some of its main competitors, with the likes of Coinbase charging 3.99% to buy Bitcoin with a debit card. Minimum deposit stands at $50 for US residents and $200 for other countries.

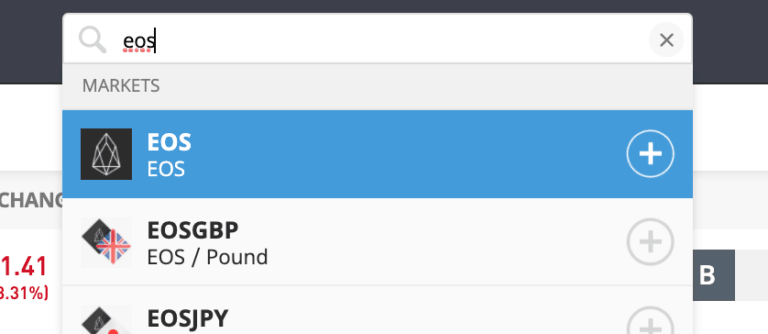

Step 4: Search for EOS

At this stage of our step-by-step guide, you should now have an eToro account that is funded. Now it’s time to buy EOS. The easiest way of doing this is to enter ‘EOS’ into the search box at the top of the page.

Then, you’ll need to click on the ‘Trade’ button to open up an order box.

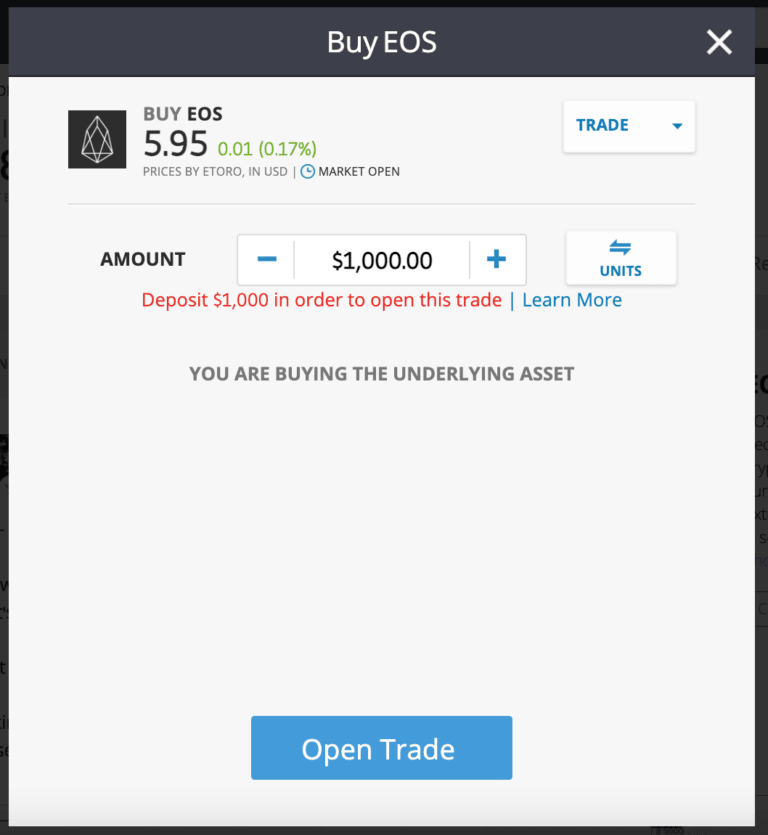

Step 5: Buy EOS

You can now buy EOS by entering the size of your stake into the ‘Amount’ box ($25 minimum).

Finally, click on the ‘Open Trade’ button to complete your investment.

Where to Buy EOS

In this section, we rundown the best platforms to buy EOS from this year. Let’s jump right into it.

1. eToro – Overall Best Platform to buy EOS

The eToro platform is our recommended broker for you to buy cryptocurrencies like EOS. The Israeli-based broker is famous for its social trading platform, which has attracted over 20 million customers from several countries. Aside from cryptocurrencies like Bitcoin, traders can invest in a variety of investment vehicles and trade commodities, CFDs, exchange-traded funds (ETFs), FX currency pairs, shares, and bonds. In fact, eToro offers exposure to 17 international markets and over 3,000 global shares.

eToro’s CopyTrader is an industry-leading innovation that allows new traders to copy more experienced traders’ trading movements. This is a great way for you to learn hands-on while securing your investment and make profit alongside.

eToro is a regulated broker and has operational licenses from top bodies like the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investment Commission (ASIC).

In addition, eToro enables traders to diversify their investment portfolio through its in-house managed CopyPortfolio functionality. This functionality allows you to spread your investment across a number of sectors and regions.

You also get to enjoy commission-free trades when you use the eToro platform. This way, you pay only for the underlying. eToro requires a $200 minimum deposit ($50 for US residents), and you can deposit through several channels like credit/debit cards, bank transfer, and e-wallet.

Pros

- Heavily regulated by top bodies like the FCA, CySEC, and ASIC

- CopyPortfolio for more diversified investment

- Top social trading platform

- Supports multiple payment methods

- Minimum share of $50

- CFD trades also offered

- Buy EOS commission-free

Cons

- Conversion fee for deposits is 0.5%

- $5 withdrawal fee

67% of retail investor accounts lose money. Invest responsibly.

2. Capital.com – Trade EOS CFDs Commission-Free

Another top platform to buy cryptocurrencies like EOS is Capital.com. Capital.com is a popular CFD broker operating out of offices in London, Cyprus, and Belarus; Capital.com is a top CFD and forex broker. The broker is regulated by the FCA and CySEC.

Meanwhile, Capital.com specializes in CFD trades, so you can trade crypto-to-fiat and crypto-cross markets on the platform. You can also trade on the future value of EOS against major world currencies like the US Dollars, British Pounds, and Euro.

Concerning user experience, Capital.com takes the top spot. Capital.com has a rich library for new traders and runs a stand-alone app for new users called Investmate. The account opening process is also fast. Aside from crypto trades, Capital.com allows trades for shares, indices, commodities, bonds, and FX currency pairs.

It also runs separate platforms for institutional clients through its Prime Division trading platform and the well-known Capital.com for retail investors. Capital.com requires a minimum deposit of $20 (same across supported fiat currencies), and you can easily fund your account with your credit/debit card, wire transfer, and e-wallet.

Pros

- No deposit or withdrawals

- Commission-free trades

- User-friendly

- Runs separate accounts for clients and company funds

- $20 minimum deposit requirement

Cons

- Offers CFDs only

- Does not support custom investment strategies

- No price alerts on web platform

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

3. Libertex – Top Broker For Crypto CFDs And Stocks

Libertex is one of the oldest online brokers in the world. Founded in 1997, the Cyprus-based broker is famous for its zero pricing structure, which separates it from the online broker industry.

Regulated by the CySEC, Libertex offers exposure to over 200 international markets spread across commodities, stocks, bonds, CFDs, FX currency pairs, and 50 cryptocurrencies. It uses the popular MetaTrader 4 (MT4) platform and the Libertex web trader. It also runs a mobile app that makes it easy for users to trade the markets while on the move.

Leverage for experienced traders is put at 1:30. New users can learn how the market operates with a demo account. You can start trading with a minimum deposit of $10 and fund your account through bank transfer, credit/debit cards, Skrill, Neteller, and several others.

Pros

- Heavily regulated by the CySEC

- Multiple platforms

- Low minimum deposit

- Zero pricing system

Cons

- Poor education system

- Charges apply for some payment methods

- Low leverage

Your Capital is at risk.

4. Plus500 – Regulated Platform Offering Different Asset Classes

Plus500 is a top online broker that started operations in 2008. It is quite popular for its top-notch CFD trades that are offered on a proprietary trading platform that is offered on its web platform and other electronic channels.

It is part of the Plus500 Ltd brand and is regulated by the UK’s FCA and is listed on the London Stock Exchange (LSE). Plus500 enable investors to trade over 2,000 financial instruments from 50 different countries, including FX pairs, commodities, ETFs, shares, cryptocurrencies, and options.

It is also user-friendly and its WebTrader 4 interface makes it easy for traders to execute trades without any difficulty. It also offers negative balance protection and stop-loss orders.

Pros

- User-friendly platform

- Regulated by the FCA

- Negative balance protection

- Access to 2,000+ financial instruments

Cons

- Limited educational resources

- Does not accept US clients

- Lacks integration with other trading platforms

Your Capital is at risk.

5. AvaTrade – Legacy Crypto Trading Platform for Investors

AvaTrade is a subsidiary of the Ava Group of Companies. Operating out of offices in Ireland, Australia, Japan, and the British Virgin Islands, AvaTrade is a top FX and CFD broker.

It is regulated in several locations in which it is situated and also by the Abu Dhabi Financial Services Regulatory Authority (FSCA).

Its trading platform is quite unique as it runs a number of separate interfaces for specific purposes. These are its MetaTrader 4 (MT4) integration alongside the AvaTrade WebTrader and AvaOptions.

It also has the ZuliTrade and DupliTrade for social copy trading. AvaTrade services several trades across the globe and enables them to trade financial instruments like Forex, cryptocurrencies, commodities, ETFs, shares, and several others. However, cryptocurrencies are offered as CFD products meaning you do not own the underlying asset.

It has a minimum deposit of $100 and you can fund your account through bank transfer, credit/debit cards, and e-wallet providers.

Pros

- Regulated in the regions it operates

- Social copy trading feature

- Great customer support

- Research and analysis tools available

Cons

- Long withdrawal window

- Offers limited portfolio

Your Capital is at risk.

6. Coinbase – Largest Crypto Exchange in the United States

Coinbase was founded in 2012 by Brian Armstrong and is the only publicly-listed crypto exchange in the world. It is based in the US and is a top destination for new crypto investors in the Latin American region. Coinbase runs two separates trading platforms, namely Coinbase and the Coinbase Pro platforms.

Coinbase mainly focuses on cryptocurrency trading and offer value-added services like storing digital assets of other institutions and enabling them to buy digital assets.

The US crypto exchange is well-known for its user-friendly platform Coinbase through which new crypto investors gain exposure to the volatile asset class. Its Coinbase Pro variant is more suited to institutional clients and experienced traders. It boasts of better fees and more sophisticated trading tools. However, Coinbase has a high deposit fee of 3.99% and does not support credit card payments.

Pros

- Great interface for new investors

- User-specific platforms

- Public crypto exchange

- Low minimum balance

- Great repository of altcoin offerings

Cons

- High fees for Coinbase platform

- Does not support credit card payments

Your Capital is at risk.

7. Binance – World’s Largest Crypto Exchange

Binance is known for one thing and that is it is the largest crypto exchange by trading volume. Having its humble beginning in China, Binance launched in 2017 and has gone on to seize the top spot from fellow Chinese Bitcoin exchange Huobi Global.

The Binance platform is the most innovative and dynamic of all the exchanges in the crypto space. it has quickly evolved into an ecosystem with the Binance Smart Chain (BSC) enabling direct transaction with the Binance exchange and decentralized exchange platforms like PancakeSwap.

In fees, Binance exchange has one of the lowest maker and taker fees with a flat 0.10% ratio and holders of BNB can get discounts while trading on the platform. The Binance exchange offers exposure to over 300 top crypto assets and is adding support to several others on a regular basis.

Pros

- Low maker and taker fees

- Top crypto exchange by trading volume

- Supports multiple payment methods

- Offers several legacy-facing services like earning interests on savings

Cons

- Not regulated by any body

- Not ideal for crypto newbies

- Debit/credit card fees are high

Your Capital is at risk.

8. Revolut – Personal Finance Service With Crypto Support

Even though it is not a trading platform, Revolut offers exposure to cryptocurrencies. It is based in London and allows users to receive, send, and exchange currencies on a quick and easy-to-use interface.

It is ideal for simple transactions and has since become the home for over 5 million users globally. Revolut’s appeal lies in the fact that it enables low cost cross-border payment settlement and you can easily convert your crypto assets to fiat in a few seconds.

Another benefit is that Revolut offers loans and travel and phone insurance. It is basically a fintech company and lets you use its virtual card to make purchases in supported regions.

Pros

- Offers loans and insurance

- Over 5 million customers

- Fast transactions

Cons

- Lacks trading platform

- Customer support is a bit shaky

Your Capital is at risk.

9. CryptoRocket – Newbie Crypto Trading and Exchange Platform

CryptoRocket is a new generation online broker and crypto exchange founded in 2018. Operating out a base in St. Vincent and the Grenadines, the platform offers exchange and trading services across several market segments spanning forex, indices, stocks, cryptocurrencies, and stocks.

However, the platform is not regulated by any formal authorities. Meanwhile, CryptoRocket has a low minimum deposit entry bar and you can start trading with as little as $10.

Deposits are limited to bank transfers, Bitcoin, and cards. So you may need to look elsewhere if you are searching for a more open deposit platform. One of the unique features of CryptoRocket is the fact that it allows for same-day withdrawal for credit card withdrawals. It offers leverage up to 500:1 and traders get trading charts and tools to aid their trading experience.

Pros

- Low minimum deposit of $10

- Absence of deposit or withdrawal fees

- Same-day withdrawals

- High leverage for traders up to 500:1

Cons

- Does not support US clients

- Unregulated

- Limited payment methods

Your Capital is at risk.

10. Changelly – Nifty Exchange for Instant Bitcoin Purchases

Changelly is a Hong Kong-based crypto exchange that enables users to buy, sell, and swap cryptocurrencies.

Changelly is a top choice given its highly intuitive and minimalistic trading platform which operates much like an automated market maker (AMM) platform. This way, users can easily get the best rates easily.

Its rates are dynamic and users get to choose between a fixed and floating rate pricing. A floating rate will see a user pay the current market value for an asset while the fixed rate will lock in the best exchange rate during the trading period. It has over 2 million users and also runs a Pro variant which enables users to earn passive income from depositing their crypto holdings with the platform. It supports over 1500 cryptocurrencies.

Pros

- Great limits and liquidity

- Easy-to-use intuitive interface

- Accepted in several countries

Cons

- Absence of phone support services

- Unable to sell cryptocurrency for fiat

Your Capital is at risk.

What is EOS and How Does it Work?

For cryptocurrency newbies looking for how to buy EOS online, it’s imperative you learn what the asset is and how it works.

So what is EOS?

- EOS is a blockchain platform that enables the development of blockchain-based applications or decentralized application (dapps)

- EOS is also the native token of the cryptocurrency protocol and it is used for network fees and for voting on the direction the platform

- It uses a delegated proof-of-stake (dPoS) unlike Bitcoin and Ethereum

- This hybrid protocol makes it faster and cheaper

- Like Bitcoin, it is built on blockchain technology or distributed computing system

- This helps it to stay decentralized with no central controlling authority

Aside from enabling peer-to-peer (P2P) value transfer, EOS blockchain also provides secure access and authentication, permissioning, data hosting, usage management, and enables the communication between several dapps platforms and the traditional internet.

EOS also uses a web toolkit for its interface development which makes it easy for developers to build in a hassle-free environment.

Founded in 2017 by serial blockchain entrepreneur Dan Larimer, EOS is one of a growing number of blockchain platforms that prioritize dapps performance. It is a member of a growing number of small-cap dapps platforms called ‘Ethereum killer.’ It uses a delegated proof-of-stake (dPoS) consensus protocol unlike the popular proof-of-work (PoW) used by mega crypto giants Bitcoin and Ethereum.

This consensus algorithm uses a real-time voting and reputation system to decide who can create the next block on its blockchain. This means the amount of EOS token a validator has will determine how often they get to verify transactions on the blockchain.

This feature has seen many people criticize the EOS system likening it to a centralized system. The EOS team is working to correct this issue.

Meanwhile, EOS runs a unique blockchain in which it does not charge users transaction fees. This is unheard of as most decentralized applications (dapps) platforms require these fees.

EOS runs on two core components; the EOS.IO and the EOS token. The EOS.IO is the operating system that lets developers build dapps on the platform. EOS claims that its blockchain has the security of Bitcoin and the ease of programming on the Ethereum blockchain. It is also highly scalable and reportedly processes thousands of transactions faster than major payment giants like Visa and MasterCard.

The EOS token is the fuel or virtual currency that is used in the EOS ecosystem. Holders use the ERC-20 token for staking in order to support the development of the platform.

During its official launch, the EOS raised $4 billion in its initial coin offering (ICO) in an unprecedented fashion. The EOS team spread the event across a whole year and it currently holds the highest capital raising round in the decentralized space.

Even though EOS has not been able to displace the Ethereum network as the go-to source for anything and everything dapps, the blockchain protocol is still one of the best platforms given its highly scalable and less energy-intensive protocol.

Why Buy EOS? EOS Analysis

Many investors joined the crypto ship all because of the phenomenal returns the emerging sector posted. This has been a major driver for its growing adoption. EOS has also seen its value spike and fall with the broader crypto market. However, if you are still wondering if EOS could be a great addition to your investment portfolio, then the following reasons should convince you.

Yield Potential

The reason why people invest in the first place is to create more wealth. This is a major driver why several people spend so many hours searching for channels or investment vehicles to grow their wealth. Traditional financial tools have aided so far but in the last two years, they have not performed as expected.

The most impacted have been the savings rates you get for keeping your money in the bank. At the moment of writing, it is less than 1% and it may likely drop into the negative. Stocks, bonds, commodities, and forex markets have helped to stem the tide of currency devaluation however, the financial market has taken a downward spiral since the beginning of the pandemic.

Cryptocurrencies have been the exception with the nascent sector leveraging on the enforced lockdown to attain a unicorn status in a few short years. Even though Bitcoin has been a runaway star, EOS has not performed poorly either.

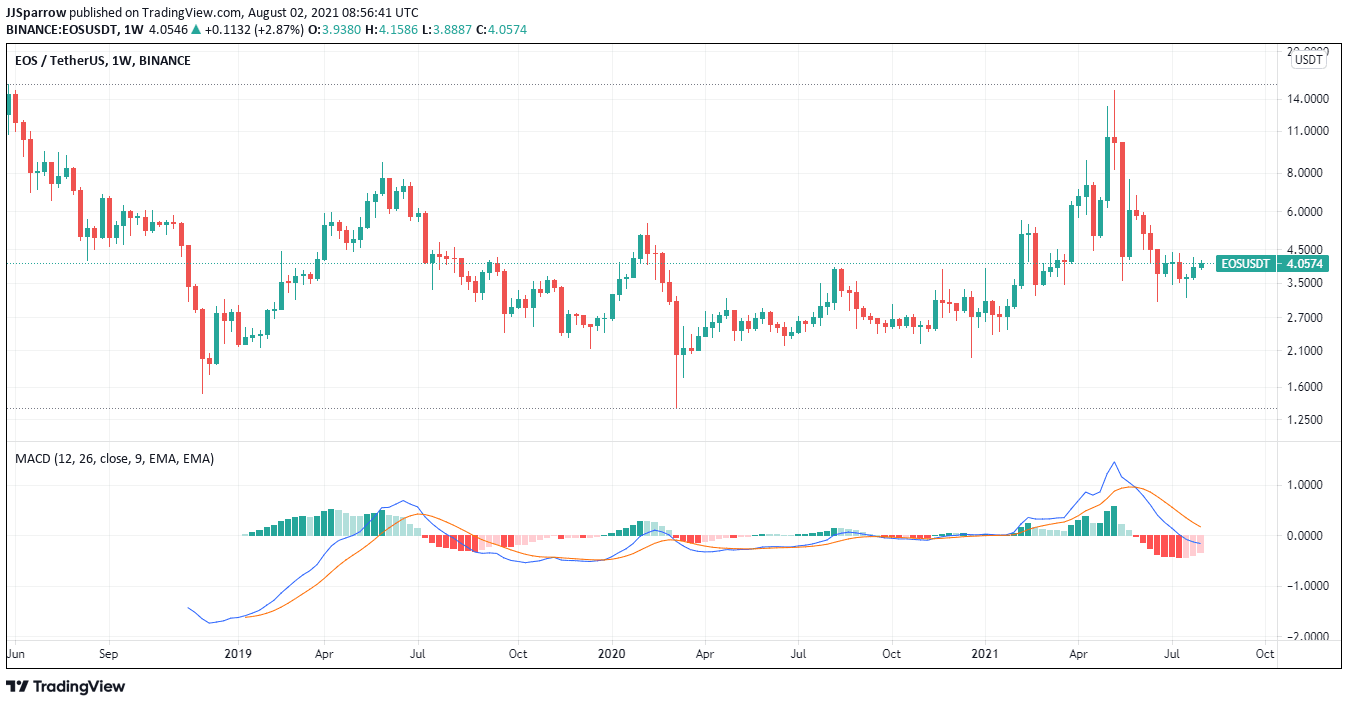

The dapps-focused token has come a long way from its 2017 price of $1.5. EOS surged to an all-time high (ATH) of $22.89 in 2018 and has shown growth potential. Even though it has not been able to surpass this record so far in 2021, EOS has risen to $14.9 in the last six months before the market correction. A growing adoption of cryptocurrencies and decentralized finance (DeFi) may see the market value of EOS make a massive recovery.

Solid Economics

The EOS token is an ERC-20 fungible token like Ethereum’s ETH. However, the major difference lies in the maximum amount of tokens that is in circulation. Like top digital asset Bitcoin, EOS blockchain uses a hard-cap limit on the number of its token in circulation. There will be only 955,500,328.48 EOS tokens ever in circulation. Unlike BTC, all these tokens have already been exhausted.

This structure makes EOS a scarce token and this will lead to its market value shooting up as demand for it grows. Given that the EOS blockchain is inherently developer-friendly and does not battle with high gas fees, the blockchain platform could become a hotbed for decentralized applications (dapps) development and this will subsequently see the EOS gain unicorn status in the long-term.

Quite Cheap

Unlike the whopping amount it will cost you to buy 1 BTC, EOS is going for a bargain right now for under $5. If you are a value-driven investor looking to buy low and sell high, this might be a great time to buy EOS and sell when it spikes to a new record value. Meanwhile, to enjoy the full value that comes with this unique opportunity you need to work with a broker that will let you buy and trade EOS commission-free. This way, you only pay for the underlying asset without worrying about commission fees. We recommend eToro as it offers 0% commission and this can improve your stake in EOS without undermining your purchasing power.

24/7 Marketplace

Unlike the traditional stock markets, the crypto market operates 24 hours, seven days a week. This makes it easy to liquidate your position anytime you want without incurring significant losses from your trade.

In addition, EOS is also highly liquid. In the last 24 hours, over $1 billion of EOS has been traded. This is a good sign that you should not have any problem if you want to liquidate your position at any time.

Is it Worth Buying EOS in 2021?

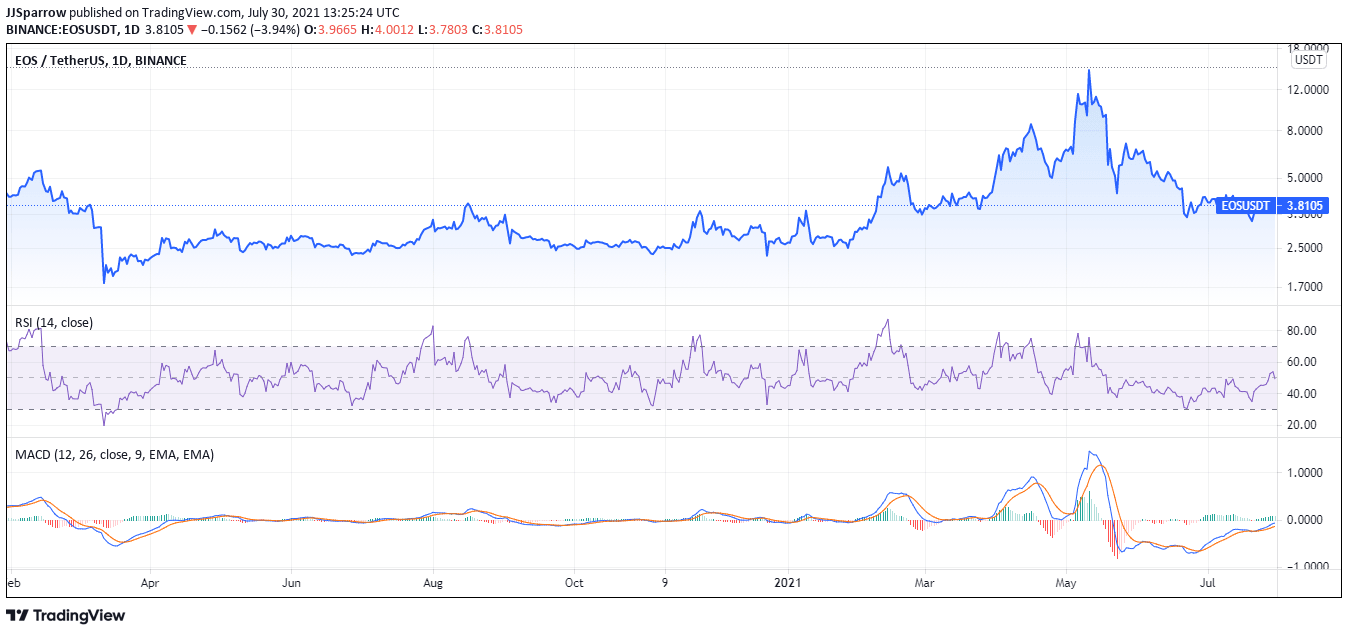

EOS has not been able to attain its record figure of 2018 but the digital asset has continued to show promise and the year is not yet over. Meanwhile, the EOS token, much like all altcoins, is tied at the hip to the price action of Bitcoin. This means a BTC rise will see it rise and a slump will see EOS ebb in its flow.

This has been apparent in 2021 in which Bitcoin spiked to a record $65,000 in April. EOS also rallied testing the $15 resistance. However, the crypto market is still under the whims of market speculators and news and this has been a huge challenge in the nascent space. Volatility concerns have made several investors to shy away from cryptocurrencies even with its ground-breaking performances.

However, a growing regulatory wave is making its way into the crypto market and this should help stem the engulfing tide of volatility.

Ways of Buying EOS

If you are searching for a channel to buy EOS tokens, this section is seeking to address that need. Some of the best options are listed below:

Buy EOS With PayPal

PayPal is the top dog in the payments space in the world. The company currently has over 40 million customers spread across the globe and its stake has increased significantly since it added support for cryptocurrencies this year. Even though you may not be able to buy EOS directly on the PayPal platform, the payment processor still plays a role in enabling crypto purchases. It allows you to buy cryptocurrency with PayPal balances. On eToro, buying EOS using PayPal is quick and easy.

Buy EOS With A Credit Card

If you are using a credit card, you can still buy EOS with it. The only thing you need to look out for is if your preferred broker offers support for credit card payments. Several exchanges do not offer support for credit card payments but this is generally demographically related. The good news is that eToro supports credit card deposits and charges a flat rate of 0.5% on it.

Also, some credit card issuers may bracket your EOS purchase as a “cash advance.” This will see you pay a fee to complete the transaction. This could range between 3 and 5% depending on your credit card issuer. You may need to look at the fine print before choosing this option.

Buy EOS With A Debit Card

Another option is with a debit card. This payment method is quick, easy, and cheap. Same way with how you buy Bitcoin with a debit card, you can also buy EOS with a debit card. The major consideration is the same. You need to consider the transaction fee. Several crypto exchanges charge differently across different payment channels. Some charge as high as 4% and some may be lower. eToro fits into the latter with a flat rate of 0.5% for all deposits.

What to Remember Before Buying EOS

Are you thinking of buying EOS? There are few things you need to be aware of before making the splash.

1. EOS Is Volatile

Anyone who has spent some time in the crypto market has run into this discussion often. The crypto market is highly volatile especially Bitcoin. This was exemplified in 2017 when BTC gained over 10,000% rising to $20,000. It subsequently dipped to $3,000 the following year losing 60% in 24 hours.

EOS has not been any different. From its 2018 highs of $22.89, it has shown checkered results. This year has not been any different. It rose to $14.9 on May 11 and has not been able to break above this resistance level so far. This is a great point you need to keep in mind if you want to add EOS to your investment portfolio.

2. Public Transactions

Another thing you need to keep in mind is that EOS transactions are open for all to see. This is because the crypto protocol uses distributed ledger technology (commonly called blockchain) which adds all transactions to a set of immutable blocks of transactions. These transactions can be queried by anyone.

3. Addresses Are Anonymous

Even though transactions are transparent, it is difficult to know who executes those transactions. This is because EOS transactions are carried out through wallet addresses which are just random combination of letters and numbers. Anyone who is curious will need to get your wallet address to be able to go through your transaction history and balance.

4. Use the Right EOS Broker

Cryptocurrencies were untradeable in several platforms a couple of years ago. However, this narrative has been flipped on its head. Now, several brokers make it easy for you to buy and trade cryptocurrencies. But this does not make it easier. Instead, you may be caught in a tight corner as to which of them offer the best trading experience for you.

We have noted some things below you should look out for before going with a particular broker.

5. Fees

Fee payments can be a thorn if you choose a wrong broker. This is because EOS trades can take a huge chunk of your invested capital. Your best bet is to use a broker who offers reasonable fees on deposits, withdrawals, trading, and even converting your EOS to another coin.

6. Support

This is very crucial especially when you trade cryptocurrencies. You may encounter some issues while using a platform and need help. A great customer support team should put you in the right track in no time. You should look at the customer support reviews before settling with any broker.

7. Payment methods

Payment methods are also crucial in choosing a broker. You need to consider the deposit and withdrawal methods. The best brokers support credit/debit cards and bank transfers. E-wallet providers like PayPal and Skrill also come in handy.

8. Volume and Liquidity

This is very important in selecting a broker. The broker must have high-volume trades for the cryptocurrency you are interested in buying. This will come in handy when you need to withdraw your funds.

EOS Price

The price of EOS is fluid. It rises and falls based on market forces. Cryptocurrencies like EOS are also more volatile meaning they can rise 20% in a few hours and close the day in the negative. This goes to show a few things.

- If market sentiment for EOS is strong and more people want to invest, then the price will rise

- This is evident in 2017 when EOS rose from $1.5 to $22.89 in 2018.

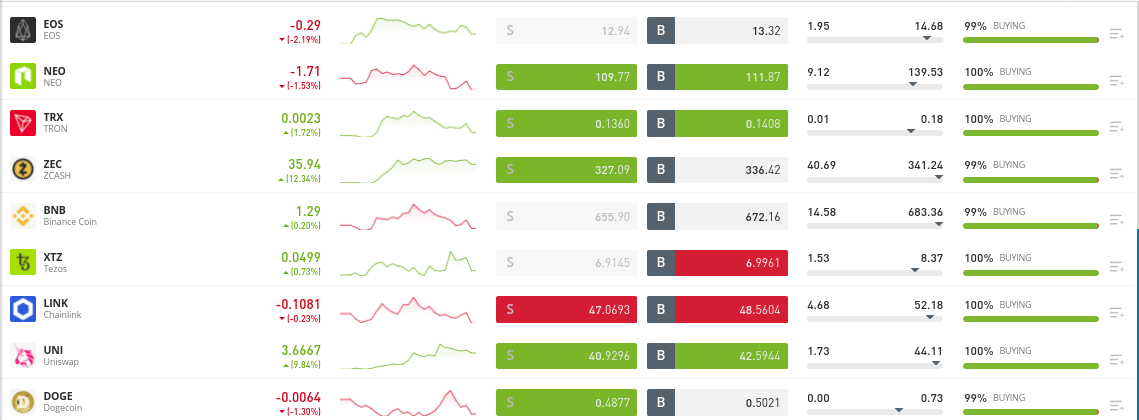

In terms of supported fiat currencies, EOS is majorly traded against the US Dollar. However, you can also buy EOS against the Korean Won, Euro, Turkish TRY, and British Pounds.

EOS Price Prediction

Like several cryptocurrencies in the market, analysts have predicted the future growth potential of the EOS token. Some like Wallet Investor have put its value for the next one year at $4.252 and at $6.025 for the next five years.

These forecasts are generally made on the token’s technical analysis. This considers an asset’s historical pricing data with the intention of predicting its future growth potential. However, this does not cover the entirety of the future price gains of the EOS tokens. The best approach is to always look at the market sentiment surrounding a crypto asset. For instance, if EOS is on a bull run, investors will naturally buy EOS for fear of missing out (FOMO). If you were able to gauge this event before the upward trend of the token, you would have been able to buy low and sell for a profit.

Investing in EOS vs Trading EOS

Like the traditional financial markets, investors apply different strategies when they trade cryptocurrencies. While others may opt for buying and HODLing for a likely profit in the long term, others may choose to trade EOS. This section considers the difference between investing in EOS and trading the digital asset.

Investing in EOS

Investing in EOS is the option chosen by a lot of new crypto users. It usually entails an investor buying a crypto asset and leaving them untouched for a long period of time. This strategy works when you are comfortable with the mission of the company and believe they will deliver on their promise(s).

Investing can also work for you if you are not interested in constantly monitoring price movements or too busy to take the time to take positions. You can just buy the coins and keep them and only sell when you have made a handsome profit from it.

Trading EOS

Another side of the spectrum is trading EOS. This entails staking your coins in a position and withdrawing when your forecast is right.

The aim of this approach is to make money when the price goes up or down. For instance, if you buy 1 EOS for $3.8 and the price goes up to $6, you would have made $2.2 from your trade.

However, the same applies to a price slump which could see you lose your investment. If you decide on trading, you will need to use the analysis of the asset as a guiding light. If you need to invest little and reap huge profits, you can turn to leverage trading – where a broker or exchange lends you more money to trade.

So, Which is Better?

Like any financial decision, it is not easy to decide. It mostly rests on your reasons for holding cryptocurrencies like EOS. Meanwhile, we have listed some factors here for you to look at:

1. Time Frame

This goes a long way in determining the strategy you choose to adopt. How long do you want to hold your EOS crypto? If you are long-term oriented, then you will not be really bothered by the price ebbs and flows.

2. Reason For Holding EOS

This addresses your motivation in holding EOS. Many crypto investors are driven by the phenomenal returns cryptocurrencies like Bitcoin have posted. They see it as a channel to financial freedom. They are but they can also lead to financial ruin if you are reckless with your money. Cryptocurrencies do not promote “get-rich” mentality even though early adopters are now millionaires. If you want to make a killing and in a short period of time, you may better off sticking with trading them.

3. Consistent Effort

Trading cryptocurrencies is hard work. Forget the fact that it is a nascent industry and is just getting noticed. If you are jumping from one hot coin to the other, there is a likelihood that you may end up with nothing and see your money deplete.

The best recommendation we give our readers is always to conduct due research and stick to the facts. A crypto’s growing adoption should be a great place for you to start and its value proposition. If you are not ready to put in the work, the best advice is to hold them for the long haul.

Buying EOS as a CFD Product

CFD stands for contracts for difference. This is an agreement between a buyer and seller that the buyer will pay the seller the difference between the current value of an asset and the value when the contract eventually ends. It takes into consideration the difference between the entry price and the exit price.

EOS is also traded as a CFD product on the eToro platform. This basically allows you to gain from EOS’s price swings without outrightly owning the asset. There are several CFD brokers that offer this service and we have treated a couple of them above. However, we recommend eToro given its social trading platform and rich repository of assets to trade.

Taxation on EOS Earnings

Growing regulation of the cryptocurrency market has seen taxes introduced into the space. Even though efforts are still ongoing, the US Internal Revenue Service (IRS) considers cryptos as “property” and they are taxed as capital gains.

Meanwhile, they are also treated as income and are subjected to income tax treatments.

Taxable events that qualify for capital gains tax in the United States include:

- Exchanging your crypto for fiat

- Paying for services rendered with crypto

- Trading a digital asset for another through an exchange or peer-to-peer (P2P)

- Taxable events that qualify for income taxes are:

- Getting crypto from an airdrop

- Earning interests from lending to DeFi platforms

- Block rewards from crypto mining

- Crypto received from rendering services

- Crypto earned from staking and liquidity pools

However, you can use the losses you incur to offset some of your capital gains. This can be as high as $3,000 from your income tax depending on the time frame.

Calculating your Capital Gains Tax

If you are a US resident, your capital gains tax will largely depend on how long you have held the assets and your income tax brackets. This will help you know:

Short-term Capital Gains Tax

If you only starting trading cryptocurrencies less than a year, your capital gains tax will be subject to your regular tax bracket. Losses incurred in that year of trading can be used to offset up to $3,000 of your trades. You can also post-date the losses into the following year.

Long-term Capital Gains Tax

This applies if you have held cryptocurrencies for more than a year. Depending on your individual income, you will pay taxes ranging from 0% to 20% in taxes. There is a comprehensive list for your perusal here.

The Importance of Responsible EOS Investment

The crypto market is the only nascent industry that has hit the unicorn status in just a dozen years. The closest is 15 years by Google and other tech giants. Bitcoin has been a majority shareholder in the success of the crypto market. However, small-cap cryptocurrencies like EOS have also contributed a significant quota to the growth of the industry.

The crypto market has attracted both retail and institutional investors and this is not hard to phantom. In a dismal financial period, cryptocurrencies have continued to perform making millionaires in the process. However, it has also wiped off several investors’ life savings and that is why this section is here. The following ideas should always be applied when trading EOS:

Consistent Research

Just like you spend so much energy in researching the companies you want to buy their stock, you need to do the same for cryptocurrencies. Do the needed research to make sure you understand the crypto protocol’s value proposition and project if their mission will be relevant in the next five years.

To help out in this exercise, you can turn to dedicated social media channels, listen to the news and expert analysis on the price movement of EOS. You can also turn to expert review sites like ours to keep abreast of the changing landscape. Inside Bitcoins has a dedicated team of market experts that give daily analysis of the crypto market.

Hedge Your Bets

It is important to look before you leap. This means, set a reasonable limit to how much you want to invest. If EOS price crosses your safety region, liquidate your position. Do not buy the idea that it may rise again, it never really does.

Would You Try EOS Mining?

Several investors always turn to invest in EOS by buying to hold or by day trading the coin. However, there is a third option which is mining. Unlike Bitcoin, EOS blockchain does not use the proof-of-work (PoW) consensus algorithm for validating transactions on its blockchain.

It uses the dPos protocol which demands less energy. And unlike the well-known proof-of-stake (PoS) algorithm, it uses a virtual mining system or cloud mining. This allows a validator to join an extant Ethereum mining pool. This way, the profits are retained by parent company Block.One and miners get a cut from the transaction fees.

Minimizing Your Risk With Crypto Investment

Two major ideas we have stated is that:

- EOS is profitable

- EOS is also risky

To hedge your investment, we recommend you follow these steps.

1. Do Your Own Research (DYOR)

This is the primary step for minimizing your risk. Forget the social media hype and focus on the use case of a particular crypto asset. This will save you from unwanted mental stress. Make sure you are conversant with how the crypto protocol operates before putting your money in it.

2. Be Careful Of Fraudulent Schemes

The crypto space is young and wild. A lot of investors have lost their funds to fraudulent schemes perpetuated on social media. Avoid buying into the idea of doubling or making 10x of your investment. Such promises always spell doom.

3. Invest Only What You Can Lose

We always recommend to our readers to only trade what they can afford to lose. Crypto investment is a minefield and you must not commit your lifesavings in a bid to get-rich quick. Always make sure the amount you put in is negligible. You can begin with little and increase your stake with time.

4. Track Your Results

You need to keep a close watch on your investments even though you are not trading the asset. This will help you to know how your crypto portfolio is holding and if it may be necessary to reassess your position. You can use apps like the eToro crypto wallet to keep track of your EOS investment.

5. Resist FOMO

The crypto market is full of this and you need to be strong-willed to be able to get anything out of it. The fear of missing out is a real investment challenge and that is why we believe doing due diligence will help in arresting this urge and minimize your risks.

Trading Robots

As well as taking the necessary precaution, you can also reduce your risks with trading robots. They will help in setting limit orders, take profit, and stop losses automatically for you.

We recommend this because these automated software are emotionless and they can help you to reduce your losses in the long-term and also make gains.

However, these software are still in their infantile stage and are mostly unregulated. This can be a problem if you are looking for one to use. Our team of experts have developed a unique vetting system that helps in discovering genuine trading bot software from the fake ones.

Some of the best robot trading software we have reviewed are:

Best EOS Wallet

Cryptocurrencies are stored on crypto or digital wallets. EOS tokens are no different. Even though there are several crypto wallets out there, only a few stand out from the crowd.

In this section, we will show you the best mobile software app that can hold your EOS tokens.

eToro Crypto Wallet

Property of social trading platform eToro, the eToro crypto wallet is one of the best crypto wallets in the space. It comes with several helpful tools and features which is ideal for inexperienced crypto investors. Aside from just storing your cryptocurrencies, you can also trade them all from the comfort of your mobile phone. You can also store hundreds of other digital assets aside from EOS.

The eToro crypto wallet is free and you can easily download it on the Google Play Store or the Apple App Store. Once you set up the crypto wallet, you will be able to execute trades like on the web platform.

In terms of security, the eToro crypto wallet operates under the regulatory umbrella of the Guernsey Financial Services Commission (GFSC). You also get a password recovery service in the even that you lose your private keys.

EOS And Other Top Cryptocurrencies

EOS is not the most valuable cryptocurrency in the market. Here, we compare against some other digital assets:

EOS vs Dogecoin

Despite the fact that Dogecoin is a joke cryptocurrency, it is one of the best performing crypto assets this year. It briefly became more valuable than Ford Motors after it surged 15,000% to 74 cents in mid-May. In terms of market cap, Dogecoin is more valuable than EOS as it is the seventh most valuable crypto while EOS is 29th. However, Dogecoin critics believe that value will trump social media frenzy in the long run and EOS is expected to move up the ranks.

EOS vs Ethereum

Even though both platforms facilitate DeFi and dapps development, Ethereum is the most valuable between the two. The second most valuable crypto platform is home to over 200 dapps and is daily increasing its stake in the booming DeFi space.

EOS blockchain has been called an ‘Ethereum killer’ and this is true given its features. Its no-fee policy is also unique in the industry. However, the blockchain still has a long way to go if it wants to top the ranks.

EOS vs Litecoin

Litecoin is the silver to Bitcoin and is a hardfork of the popular crypto asset. However, it is faster as it enables block finality on time. However, it uses the PoW protocol and in the event of peak trading hours may see its TPS slow down considerably.

EOS maybe faster than it with its dPoS protocol but Litecoin is the 13th most valuable crypto in the space. It is also tradable on several exchanges and platforms.

EOS vs Libra

In a rough sketch, Libra is meant to be a stablecoin. Founded by Facebook, Libra’s value will be backed by a basket of some of the most popular fiat currencies. However, the project has remained in the dark due to regulatory issues. It has since rebranded to “Diem” and the body behind the project believes that it will hit the market this year.

Where Does EOS Go From Here?

With the current state of the crypto market, you may be skeptical about buying EOS given the severe downtrend the market has experienced in the last few months.

However, this trend is not expected to last for long. The crypto market is already welcoming back the bulls after Bitcoin rose 10% in overnight before regressing to the $38,000 mark. EOS has also benefited and risen 4.88% in the last 24 hours to $3.87.

This could be a great time to buy EOS given the market sentiment surrounding Bitcoin.

eToro – Best Place To Buy EOS

EOS has come a long way this past few months despite the volatility that has set it back. Even though it has not retested its highs of 2018, this year may see the digital token end on a high note. This is because there is growing interest in the DeFi space and more investments are coming in. With EOS being a member of a crop of top dapps platforms, there is a growing probability that it may see its value rise with growing adoption. So, if you want to buy EOS, you can check out eToro to get started in as little as five minutes.

You should also remember the following:

- Investing and trading EOS needs effort and research

- EOS is volatile, so price swings should be anticipated

- Always use a regulated broker and exchange

- Check out review sites like Inside Bitcoins for expert analysis to learn about EOS

- Resist FOMO. Only invest according to your findings

eToro – Our Recommended Crypto Platform

- ASIC, CySEC and FCA regulated – 20 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet – Unlosable Private Key

- Staking Rewards for holding ETH, ADA or TRX

- Copytrade Winning Crypto Traders – 83.7% Average Yearly Profit

68% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How do you buy EOS?

There are several platforms that allow you buy EOS online. However we recommend a regulated broker like eToro. Besides its ease of use, using a trusted platform like eToro ensures the safety and protection of your funds.

Should I Buy EOS?

This decision solely rests in your hands. However, EOS is known for its price swings which happens on a daily basis. If you eventually decide to invest in it, make you only invest what you can afford to lose.

What is the Best Way to Buy EOS?

The best way to buy EOS is through a regulated platform like eToro. Other means of buying EOS such as Peer-to-Peer platforms or through a cryptocurrency ATM might be too risky or too stressful. Using eToro, you can complete the transaction from your bed.

How does EOS work?

EOS is a virtual currency built on blockchain technology. This makes the platform decentralized, meaning there is no central authority. In terms of its price movement, EOS value is determined according to market sentiment.

Is it Safe to Buy EOS?

EOS is a relative safe investment to get into. Your funds won’t magically disappear after purchase. However, it carries certain risks much like any investment. Meanwhile, if you have done the needed research, you shouldn’t have doubts about the potential earnings from this investment.

How Do I Make Money With EOS?

You can make money from EOS by day trading the asset or buying to hold for the long term.

What are the Benefits of Buying EOS?

EOS is a good investment for savvy investors. This is because the protocol’s relevance will continue to grow as DeFi interest surges. So, buying it for a bargain can post major gains in the future.

What are the Best Payment Methods to Buy EOS?

We recommend using your debit card. However, if you have funds in your PayPal or Square account, you could also use them. This is dependent on what payment methods your broker supports.

Who are the Best EOS Brokers?

Several platforms enable EOS trading and investing. However, we recommend eToro and Binance as both platforms are hugely popular among crypto investors and are secure.

How Can I Buy EOS Instantly?

To do this, you need to open an account with a regulated broker such as eToro and verify your account. Once this is complete, you will be able to make EOS purchases easily.

How Can I Buy EOS With USD?

You can buy EOS today with your Dollar denominated card on eToro.

What are the Taxes on Trading EOS?

This is hugely dependent on the region you operate from. But for US residents, you can check out the details from our EOS Taxation section in this article.

How Much Is EOS Worth?

EOS value changes often due to volatility. At press time, EOS is trading at $3.87.

How Do You Mine EOS?

Unlike Bitcoin, EOS uses a delegated proof-of-stake (dPoS) which means it does not allow validator nodes to compete for block rewards. Instead, it delegates transactions to nodes with high EOS tokens. This cuts out the energy demand, and thus means EOS cannot be mined directly.

Comments are closed.